Hello and welcome back to today’s post dear trader.

In today’s post, I will be sharing with you how trading the Forex market can be an exciting way to earn additional income.

However, before you start trading, you need to learn a few things.

Knowing what to expect, what tools you need, and a few techniques will help prepare you so your entry into trading is as smooth as possible.

So, let’s get started.

The following things need to be considered before you start trading.

1. Getting To Know The Market:

Traders can trade within many different markets, which include the stock market, Forex market, options market, and Contract for Difference (CFD) markets.

The stock market involves buying/selling shares of a company.

The Forex market is the largest in the world and involves the exchange of one currency for another.

The options market allows participants to undertake positions in the derivative of an asset, so the option is not ownership of an underlying asset.

The contract for difference (CFD) market allows traders to speculate on the rising or falling prices of instruments such as currencies, shares, indices, and commodities.

When a market is moving downward, it’s called a bear market.

You can take advantage of this through ’short selling’ which involves selling assets or (derivative) you do not own in the hope of buying them back at a lower price in the future.

The difference is your profit.

Short selling can be very risky as your losses are unlimited, and you could lose more money than you have in your trading account.

This is because the shares could rise, so you would have to cover the difference.

Therefore, short selling is not advisable for novice traders.

When a market is moving upwards, it’s called a bull market.

You can benefit from this by ‘long buying’ assets as you are hoping that the share price will rise higher and you will make a good profit on your investment.

If the position moves in the opposite direction, the maximum loss is what you paid for your shares.

Trading CFDs allows you to not only profit from upward trending markets but also from a downward trending one. Traders can determine which direction they predict the market will go and invest accordingly.

Trading CFDs allows you to invest with leveraged products, which means that you have more buying power to profit on your investment.

However, although potential profits are greatly increased, potential losses can also be increased. This is where it is essential to have a strong risk management plan.

CFD brokers provide investors with access to a wide range of CFDs on currencies, indices, commodities, and shares.

You must ensure that your open trading account has sufficient funds in it at all times. If your account balance falls below the close-out level, then your broker reserves the right to sell your financial instruments to cover your margin requirement.

2. Learn Everything You Can About Trading:

You should plan on devoting a considerable amount of time and effort to acquiring the right knowledge and skills before you start trading.

Education is number one, as you just cannot succeed as a trader without education.

Learning to trade is no different than learning any other profession.

Many traders see trading as a hobby instead of looking at it as if it is their own business.

However, hobbies cost money, and the main goal of trading is to make money.

Many unsuccessful traders have treated their trading like a hobby, but this does not lead to consistent profits.

Before you trade with your money, learn everything you can about investing and the markets, as mistakes can be very expensive.

Read financial articles and everything related to the financial markets.

Start to follow the market every day and read about price action in foreign markets.

Study the basics of technical analysis and look at price charts in all time frames.

There are a lot of free educational resources here on this website that teach you how to trade, as most brokers offer their own educational resources and professional traders who can guide you.

Here we have enhanced educational resources with articles, one-on-one courses, a trading glossary, a Forex eBook, and trading strategies.

Learn from our team of market experts with up-to-the-minute analysis.

You also need to get familiar with charts and how prices move.

Learning the basics of reading charts and quotes is very important as charts form the base for technical analysis.

Daily, weekly, monthly, and intraday charts display both fundamental and technical data.

With technical analysis, analysts and investors can gauge the recent and historical prices of a stock, which is used to make predictions on future price movements.

3. Develop A Trading Strategy:

A solid trading strategy is fundamental to your trading success, and it’s best to take advantage of the market when you are confident in your strategy.

Your strategy should consist of a strict set of rules, guidelines, and hours of analysis and testing.

If you apply your trading plan consistently, it’ll give you an advantage.

If you are not 100% confident in your trading plan, you really shouldn’t be trading with real money, but you can; check out our simple beginner trading system strategy here.

Diversify your portfolio by investing in multiple types of investments so that if one does not do well, the others in your portfolio make up for the loss, and you still end up earning money overall.

4. The Amount Of Money You Want To Invest:

You can’t make a living through trading alone.

Trading is an investment opportunity to increase your wealth, so if you don’t have a job and source of income, or you have a job but not enough income, you have to establish a reliable and strong source of income first.

Then you can use some of the money you make to make more money through trading.

You need to be financially prepared to take losses; otherwise, trading will be a real struggle for you.

Not only will it affect you financially as you watch the market take your money, but emotionally as well.

If you can make consistent profits in trading, you can be able to deal with consistent losses.

5. Finding The Right Broker:

A broker is the go-between for traders and the financial markets.

There’s always a buyer and a seller for every transaction.

Choosing the right CFD broker is essential to success, check out our recommended broker here.

As a trader, you want a broker that has low commissions and fees and wide, variable spreads.

6. Practice On A Demo Account Before Depositing Money:

After you have learned and focused your education on a specific strategy, you need to test it all out by opening a demo account where you can practice your strategies without risking real money.

Practice placing trades by forming strategies and testing them on historical price charts.

Place trades based on those strategies and analyze the results to see if the strategy will produce a profit.

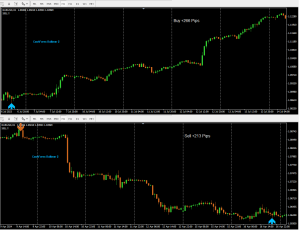

Build your market confidence with the CashForex trading system strategy in a completely risk-free environment where you can open a demo account and practice with $50,000 of virtual funds.

Just remember that if you can’t succeed on a demo account, you are not ready to trade on a live account; it is that simple.

On the other hand, profiting on a demo account does not necessarily mean you will make real money profits as easily on a live account.

After you’ve proven yourself on a demo account, you can open a live account.

7. Trade On A Live Account With Your Money:

Trading is exciting because it involves risk and reward.

Trading is the easy part; being successful is the hard part, so focus time on the process every day and learn how to eliminate mistakes and enhance your strengths.

Don’t focus on results, but think about all the things you need to do leading up to that.

The most important thing is to manage risk at all times.

Registering with a well-regulated Forex trading broker as we recommend here usually takes just a few minutes, and when the details you provide have been verified, you’ll need to fund your account with a minimum amount of $25.

Now it’s time to find your first trade.

With your regulated Forex trading broker, you’ll be able to go long and short on CFDs on forex, indices, commodities, and shares.

When you’ve decided what you want to trade, you’re ready to open a CFD position and place a trade.

It is very important that when investing in any market, you are only using disposable income that you can afford to lose. If you want to develop a successful trading career, you need to focus more on the journey rather than the destination.

Trading is not something you learn once and become a master of.

The financial world changes constantly, and if you aren’t willing to stay up to date, keep learning, and continuously test your knowledge, you will find it difficult to make consistent profits.

However, with the right knowledge, skills, and experience, anyone can trade on the market.

Congratulations, as you plan and make every right effort to succeed as a financial market trader.

Based on its beginner friendly and profitable user experience as a trader, here is my recommended technical indicator for you as a beginner today (Band Single Indicator).

Also, to join other beginners in my recommended ongoing 14-day Career Freedom Opportunity, click here

P.S.: If you have any questions regarding this post, kindly go ahead and comment in the comment section below or share this post with your Forex trader friends using the share button on this post page. Thank you!

I want to see you succeed in life and in your financial market trading career.

Talk to you soon,

Daniel Ohuegbe,

14-Day Career Freedom Opportunity Founder And CashForex Trading System Creator!

14-Day Financial Market Success Mentor!

Dedicated To Redeeming Your Financial Freedom!